RFID bank fixed asset management gives different safety and efficiency

[ad_1]

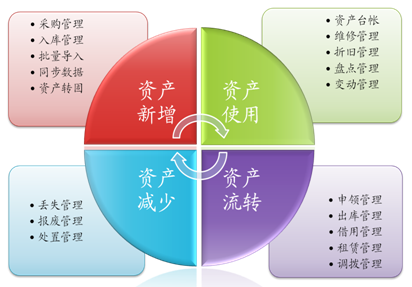

Bank’s fixed asset management is a very important area for banks. Due to the large number of fixed assets such as bank office equipment and electronic equipment, it has increased the difficulty of management. In the past, traditional bank asset management was under management, and efficiency was not ideal, and various problems were prone to appear. The application of RFID technology to intelligently and informationally manage the bank’s assets not only solves the problems of bank asset management confusion and inconsistencies in the accounts, but also realizes efficient asset management and inventory statistics, which greatly improves the bank’s fixed assets. The efficiency of asset management ensures the safety of fixed assets. RFID bank fixed asset management gives different safety and efficiency.

Due to traditional management, there will be problems such as decentralized asset management, difficulty in unified deployment, false asset value, serious asset loss, manual asset inventory recording, long inventory cycle, poor efficiency, and high error rate. The technology and management methods of asset management will be greatly changed due to RFID technology. RFID bank management application has become the patron saint of a new generation of asset management. Using RFID electronic tag automatic identification technology, it can be used for bank informatization management of employees, VIP customers, physical assets and documents and files, including automatic collection of RFID channel door entry and exit identification, timely and accurate information transmission background business management platform .

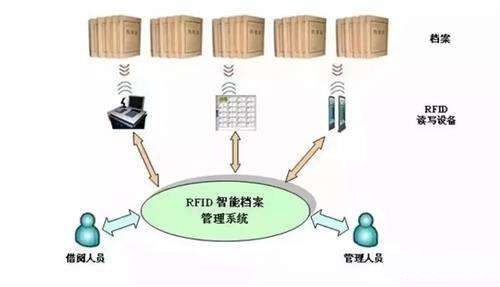

File management:

When the account manager makes the personal loan file, he sticks an RFID tag on the file and writes the information into the RFID electronic tag. When the files are circulating in each position, the RFID reader of each position will identify the RFID electronic tags on the files and record the tracking status information. After filing cabinet files, you can use the handheld RFID reader to find and count, which is convenient and quick. Including the warehousing and inventory management of collateral files, RFID can also be used, which is faster and more accurate than traditional bar codes. The inventory can be completed in just a few minutes.

Bill anti-counterfeiting management:

For important bank bills, RFID technology can be used for anti-counterfeiting, and tracking processing is faster. It is to encapsulate an RFID chip when printing bank notes. Read or write the corresponding electronic information to the RFID chip in the process of issuing bills and circulation.

Cash drawer transfer management:

Automatically identify the cash drawer to prevent transfer errors and identify the authenticity of the cash drawer. The program uses RFID intelligent management methods to control, monitor and record the entire process of escorts or collection personnel’s door-to-door collection. The full cooperation of RFID electronic tags, fixed readers, handheld data collection terminals, and bank communication systems is the basis for ensuring the success of this program. After each business outlet receives the cash box that arrives under escort, the system can automatically check the information and sign for it automatically. The receipt information will be transmitted to the cash operation management back-end system through the bank dedicated line network in real time, which improves the accuracy and work efficiency of cash drawer transfer.

Treasury management:

Deploying RFID readers at the key points of the entrance and exit of the (treasury) cash box — automatic identification of entry and exit, greatly reduces the possibility of human intervention in the circulation link and provides a guarantee for the safety of cash operations. In the warehouse, the hand-held terminal can be used to conveniently check the inventory cash box.

Personalized customer service:

When the customer enters the bank door, the RFID reader at the door automatically reads and recognizes the bank card/credit card or VIP card with built-in RFID chip carried by the customer, which allows the bank account manager to receive the customer’s arrival as soon as possible Information, make arrangements and preparations for personalized services. There is no need to ask customers whether they are VIPs, which level of VIP, and other questions that annoy customers and should not be asked repeatedly.

Asset management is one of the more important parts of the bank’s internal management. Compared with manual management and bar code management, RFID fixed asset management technology can help banks to manage informatization and intelligent asset management, and build for the management of fixed assets. More solid security walls.

[ad_2]