RFID intelligent collateral management system solves the problem of bank risk control

[ad_1]

With the increasingly stringent supervision of the quality of loans issued by commercial banks in my country and the increasing awareness of credit risks, as well as the increasing supervision of the source of credit risks of commercial banks by the banking supervisory authorities and the implementation of the loan risk accountability system, commercial banks are When handling the mortgage and pledge guarantee business, more and more attention is paid to the ability to dispose of the collateral and the ability of the loan company to repay the second year, and to continuously strengthen the management of the collateral to prevent the occurrence of financial cases.

Commercial bank collateral management is an important part of the overall risk management system. However, in practice, it has been shown that many commercial banks currently have a serious lack of understanding of the management of various collateral materials, and their risk awareness is very weak. It is enough to stay in line with the general management operation process, and the potential risks are huge. Therefore, systematic management and efficient physical management mechanisms can effectively solve this practical problem.

The collateral management system based on RFID technology uses various types of tags to identify different collaterals, and stores the collateral data in the tags or the system as needed to realize the full life cycle of collateral storage, maintenance, inventory, and allocation. Management, real-time monitoring and management of important collaterals, to ensure that the accounts are consistent, and the accounts are consistent, which greatly improves the efficiency of collateral inventory.

Three goals for the construction of the bank’s RFID collateral management system:

Improve the original collateral database: realize the integrity and standardization of collateral information through collateral ID labeling management; adopt unified collateral categories, classify collateral management, and establish a unified collateral ID code according to the collateral category Rules; combined with PDA technology to realize daily management of equipment and reduce the problem of inaccurate data caused by human management.

Standardize the collateral management process: After the system is established, the system can effectively realize the inquiry, data entry, approval, and initiation processes (collateral storage, collateral export, collateral transfer, etc.), statistical analysis, Treasury management and other services; in accordance with the requirements of the process specification, the corresponding process files and documents are automatically generated; to help the collateral management personnel to reduce manual and manual work as much as possible, and complete the input, allocation, and allocation of collateral information in an agreed and automatic manner. Transfer and other processes; provide a large number of data interfaces to facilitate batch import and export of data, minimize manual entry work, and improve work efficiency.

Regulatory requirements and operating procedures for the entire life cycle of collateral:

Establish a unified collateral management platform, and the physical files of collateral are centrally kept by the head office center;

Centralized and clear unified handling process, standardized process management;

After the front desk business is completed, all the collateral will be sent to the head office center for centralized storage;

Set up a file room in the head office center to centrally manage all collaterals. The storage place meets the conditions of warrant management. Two people keep two people in and out to prevent fire, theft and other security hazards;

The head office file manager conducts centralized management, monitoring, and inventory operations on collateral;

The system interacts with core data daily to realize various statistical monitoring and early warning functions of collateral;

The head office regularly conducts physical inventory work, regulates the frequency of inventory, and combines physical inventory with electronic label inventory to ensure that the accounts are consistent;

Regulate the custody of warrants that have not been put in the warehouse in transit, and all the warrants that have registered the ownership of mortgage and pledge should be put into the warehouse and included in the accounting, and the account manager shall not be kept on their behalf.

Nowadays, collateral supervision has become an urgent need of enterprises, governments and other organizations. It can provide the entire life cycle management of collateral, and realize the consistency of account cards and accounts in the stages of construction, use, maintenance, and clearing out of the warehouse.

Four major contents of RFID collateral supervision:

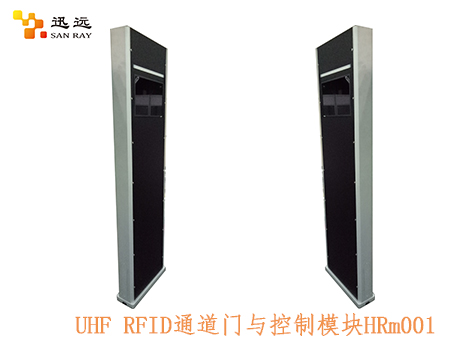

Collateral file management: After the company’s collateral purchase is checked, the operator uses the RFID card issuing machine to issue an RFID collateral management label for the new equipment. The label includes the collateral number, the name of the collateral, the date of purchase, and the custodian , The status of the collateral and other information such as the telephone number of relevant personnel, the label is pasted or hung on the surface of the collateral, and the system records the completion of the collateral storage. The RFID collateral management label will be used together with the collateral life cycle to facilitate the process of obtaining, returning, and inventorying the collateral in the future work of the operator.

Collateral Requisition Management: When the company uses the collateral in the warehouse, the operator uses the RFID handheld terminal to read the label information on the collateral, confirms that the collateral is taken correctly, and then uses the handheld device to modify the RFID collateral management label data, and the system automatically modifies the collateral With regard to relevant information such as outbound, collateral recipient, collateral status, etc., the collateral outbound operation is completed in one step, reducing the work intensity of operators and reducing the error rate. When the collateral user changes, the operator only needs to use the RFID handheld terminal to read the information of the RFID collateral management label attached to the collateral, and use the handheld terminal to rewrite the user information after confirming the information. The system will automatically modify other related information for the convenience of the operator Work.

Collateral settlement and outbound management: When the warehouse is settled out, a branch will submit relevant information such as loan settlement and warrant release to the center, and the central auditor will go through the outbound formalities after checking that there is no error, and perform the settlement out of the warehouse operation in the system And transfer the mortgage and pledge warrants to the branch. After confirming the information, the system automatically revises the relevant information, reducing the operation and personnel work intensity, and reducing the error rate.

Collateral inventory management: The purpose of collateral inventory is to check the difference between the collateral and the real thing, so as to make corresponding treatments, to achieve the matching of the account, and paste the RFID label of the collateral number on all the collateral; when taking inventory , Download the collateral account to the handheld terminal according to the location of the collateral on the account, and the inventory staff will take the handheld terminal to the corresponding location to scan the RFID tags on all the collaterals in the location according to the work plan. The terminal automatically completes the comparison between the actual inventory of collateral and the book situation; after the inventory is completed, a collateral difference table is formed, and the difference data is unified and manually processed according to the corporate collateral management method.

Six major functions of RFID collateral management system: daily collateral management function, collateral monthly report, collateral comprehensive inquiry, inventory function, system maintenance function, security management function. Since during the entire inventory operation process, there is no need for operators to distinguish, record, and manually input data, work efficiency and data accuracy are greatly improved.

[ad_2]