Bank customer identification system

[ad_1]

Business needs

When banks provide customers with financial services such as account opening, account cancellation, large deposits and withdrawals, credit card business, credit business, etc., they need to identify, verify, enter, and archive the customer’s identity documents. The traditional mode is accomplished by the bank staff’s visual identification, verification, manual entry of ID card information, and copying and archiving. The work efficiency is low, and the waiting time for customers is increased, which is easy to make customers feel unpleasant.

Therefore, the establishment of a bank customer identity recognition system to realize automatic identification, entry, verification of ID information, automatic archiving, and printing of identity documents can greatly reduce the workload of bank staff, improve work efficiency, increase customer satisfaction, and greatly reduce human effort. Errors caused by the operation.

The Anti-Money Laundering Law of the People’s Republic of China stipulates: “Financial institutions established within the territory of the People’s Republic of China and specific non-financial institutions that are required to perform anti-money laundering obligations shall take preventive and monitoring measures in accordance with the law, establish and improve customer identification systems, Identity data and transaction record retention system, large-value transaction and suspicious transaction reporting system, fulfill anti-money laundering obligations.”

On June 29, 2007, the People’s Bank of China and the Ministry of Public Security established a networked verification system, and all banking financial institutions across the country joined the system. Banks can verify the citizenship information of relevant individuals through the system when handling bank account business and bank account-based payment settlement, credit and other businesses, so as to conveniently and quickly verify the authenticity of the resident ID card presented by the customer. For this reason, the established bank customer identification system should also have the function of online verification.

System composition:

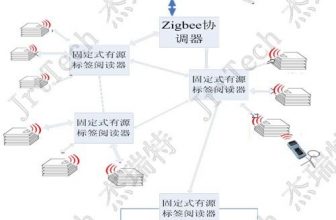

It consists of a mobile terminal, a secure access platform and a front-end and back-end application software system.

Function description:

By loading ID card verification, fingerprint collection and comparison, portrait collection and recognition, 3G communication and other modules on the mobile terminal, it can realize on-site remote identity authentication for bank customers and assist in the processing of credit card, credit and other businesses. The system can also load knowledge Applications such as library, product promotion, and mobile office are suitable for working environments such as on-site outings and business halls.

[ad_2]