RFID bank cash box circulation electronic identification system solution

[ad_1]

1. Business requirements

With the rapid development of the national economy, the scale of banking business has continued to expand and business outlets have increased. A large number of cash boxes containing cash, bills, seals, etc. are frequently stored and transferred between the treasury and bank outlets every day.

● At the bank vault side, the transfer management of the cash box still adopts the traditional manual operation method, which is not only labor-intensive and inefficient, but also because the cash box enters and exits the vault only simply registers the quantity, and does not register and check the cash box such as number and outlets in detail. Key elements such as name and time of entry and exit make it difficult to distinguish the true and false of the entry and exit cash box, and there are serious security loopholes.

● In the process of circulation, the transfer registration information between the main cashier and the clerk, and the clerk and the warehouse clerk cannot be shared. There is no linkage restriction mechanism for the three parties, and it is easy to happen that the cash drawer is incorrectly taken, missed, and swapped.

● In terms of bank management, since the status of all cash drawers cannot be monitored in real time, it is extremely prone to blind spots in security management, and it is also impossible to command and dispatch the safe and scientific circulation of cash drawers on a unified management platform.

How to realize the intensive, automated, scientific, and refined management of the bank’s cash drawers, on a unified management platform, to ensure that the cash drawers are quickly and accurately stored in and out of the warehouse; register and hand over correctly to avoid errors such as mishandling, omission of taking, and swapping; Real-time monitoring of the cash drawer status to avoid security blind spots is of great significance to ensure the safety and scientific circulation of bank cash drawers, and it is also an urgent problem that banks need to solve in the course of rapid development.

Second, the system architecture

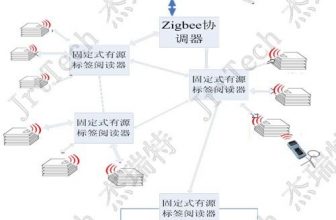

Install remote identification on the cash drawerRFIDElectronic tags, the recording process of cash box entering and exiting the treasury, and bank branch handover are automatically recorded by identifying the electronic tags.

Trolleys are used to enter and exit the vault. Through the use of a door-type radio frequency reader, dozens of cash boxes in a cart can be quickly and easily accurately identified, and the system backend writes the data to the VCTS.

When the cash box is delivered to the business outlets for handover, the handheld radio frequency is usedReader, Record luggage entry and exit information, easy to operate collection of cash drawer label information, and quick and timely information reporting.

Three, application process

1. The vault side

The electronic identification control method of the cash box electronic identification and transfer system replaces the traditional manual identification and manual registration of various elements of the cash box in and out of the warehouse. This completely changes the previous manual transfer method and greatly reduces the labor intensity of the cash box in and out of the warehouse. It is effective Shorten the time of entry and exit, and improve the efficiency of cash drawer registration.

2. Business outlets

When the cash box is in and out of the warehouse, the electronic tags in the cash box are scanned by the read-write scanning device installed at the outlets under the jurisdiction of the purchaser to identify and check whether the transferred cash box belongs to the luggage of the branch, and the scanned information is transmitted to the bank vault cash allocation system in real time , The system automatically records the number, quantity, name of the branch and handover time of the cash box in and out of the branch; at the same time, the branch can also grasp the delivery status of the cash box through the electronic cash box identification and transfer system of the teller. It is displayed as “at the branch”, the cash box is transferred from the branch to the vault but has not arrived at the vault, and the status is displayed as “in transit”; You can check the status and details of the cash drawer in and out of the outlets with each other to prevent the cash drawer from being picked up by mistake.

Four, system characteristics

1. The entire system has the characteristics of rapid identification of long and short distances, high reliability, high confidentiality, easy operation, and scalability.Can be combined with

The bank’s existing treasury management system platform is docked to realize the intensive, real-time, and automated cash drawer management.

2. The global unique ID number and electronic tags that cannot be modified are used to record the cash box information, which is safe and reliable, and can effectively avoid the risk of the cash box being repackaged.

3. Using RFID automatic identification technology, it is possible to read the information of multiple cash boxes at the same time, effectively reducing the labor intensity of the cash box in and out of the treasury, shortening the time in and out of the treasury, improving work efficiency, and improving the accuracy of the cash box handover.

4. Through the docking with the bank’s treasury management system platform, the status of the cash drawer can be monitored in real time to avoid security blind spots.

5. During the cash drawer transfer process, the main cashier and evacuator, as well as the evacuator and the treasurer, can exchange cash box transfer information through the system, reducing mistakes such as mishandling and omission of the cash drawer during the transfer process.

5. Implementation benefits

1. Intensive, real-time, and automated bank cash box management has been realized. By connecting with the bank’s existing treasury management system platform, the bank’s refined management level has been effectively improved.

2. At the treasury side, through the application of this system, the cash drawer can be quickly and accurately moved into and out of the treasury, which completely changes the traditional manual operation method of the treasury, shortens the time of in and out of the treasury, greatly improves the work efficiency and accuracy, and avoids This eliminates the security risks caused by the difficulty in distinguishing the authenticity of the inbound and outbound cash box.

3. At the business outlets, the electronic label information of the cash box is read to the bank’s treasury management system platform through the handheld scanner, which can effectively avoid the risk of mishandling or missing the cash drawer.

4. The bank’s ability to monitor the status of the cash box is improved. The bank can know the status of the cash box in the treasury, escort, and business outlets in real time through the system background. It avoids the blind spot of cash box supervision caused by untimely information feedback and the huge risks caused by it.

In short, the implementation and application of the system has great practical significance for the management of bank cashboxes in and out of the warehouse, real-time status supervision, and avoiding risks caused by work errors. It has been consistent with the implementation of the system. The affirmation and praise.

[ad_2]