Beitu High-tech Fingerprint Recognition Bank Savings System Solution

[ad_1]

With the rapid development of the social economy and the ever-increasing improvement of people’s living standards, the amount of personal deposits across the country has also increased significantly every year. At the same time, in order to better adapt to the development of the market economy, banks across the country are also transforming into commercial banks. In terms of operating methods and methods, in addition to paying attention to the quality of loans, banks must also pay more attention to attracting more depositors, especially individual depositors. It goes without saying that banks have already launched fierce competition in attracting depositors.

At present, in terms of deposits and withdrawals of various banks, whether they choose credit cards, savings cards, or passbooks, the confirmation of the legal identity of depositors is determined by means of passwords. People who maliciously steal the password can also guess the password of the depositor’s account by repeatedly observing the password input by the depositor. Once the depositor’s credit card, debit card, or passbook is obtained, the illegal stealing of the depositor’s funds is like a treasure.

Since the development of fingerprint identification technology, it has matured and moved towards practical application. In fact, people’s knowledge of fingerprints has been profound since a long time ago. Human fingerprints have always been used as an important means of identity verification because they have the characteristics of “unchanged for life and different for each person”. The ancients often said “signing and drawing”, which refers to pressing the fingerprints. Of course, today’s fingerprint recognition technology is not what it used to be. Due to the rapid development of electronic and computer technology, the collection and identification of human fingerprints can save ink printing and manual identification. The combination of modern fingerprint recognition technology, computer software and hardware technology, and photoelectric technology makes it simple and convenient to use fingerprints to identify the identity. You only need to gently place your finger on the fingerprint collection window, and the computer will automatically give the recognition result.

Password identification technology replaced by fingerprint identification technology will set off a technological revolution in the field of identification in banking, securities and other industries. The benefits it brings to society are manifold.

System functions

Basic functions: Depositor identification: Convenient, accurate and rapid identification and confirmation of the depositor’s identity, preventing illegal withdrawal of other people’s bank deposits, is the main function of the bank’s fingerprint savings system.

Extended functions: Authorization management: Strictly manage the bank’s various authorized services to prevent internal personnel from exceeding their personal authority to engage in various banking services. For example: the authorization of director business, the current authorization is identified by IC card, and the banking system does not have any identification process for the cardholder, that is to say, anyone can engage in various director business as long as they get an IC card . After changing to fingerprint authorization, the above loopholes can be blocked. 3. System structure In the fingerprint savings system, the fingerprint collection and identification module is plugged into the UNIX system. In fact, it is the way that the fingerprint comparison function module communicates with the UNIX savings system. Therefore, the UNIX system has very little changes. Each deposit point of the bank sets up a server, which is responsible for all fingerprint comparisons. Each savings window can be installed with a fingerprint workstation and connected to the fingerprint comparison server. All workstations only collect fingerprints and send the collected images to the fingerprint server for verification.

system structure

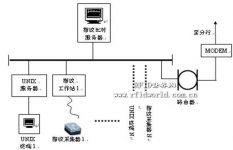

In the fingerprint savings system, the fingerprint collection and identification module is plugged into the UNIX system. In fact, it is the way that the fingerprint comparison function module communicates with the UNIX savings system. Therefore, the changes to the UNIX system are small. A server is set up at each savings point of the bank, which is responsible for all fingerprint comparisons. Each savings window can be installed with a fingerprint workstation and connected to the fingerprint comparison server. All workstations only collect fingerprints and send the collected images to the fingerprint server for verification.

The structure is as follows:

Schematic diagram of fingerprint savings system

[ad_2]