RFID bank cash box circulation electronic identification system solution

[ad_1]

system introduction

With the rapid development of the national economy, the scale of banking business has continued to expand and business outlets have increased. A large number of cash boxes containing cash, bills, seals, etc. are frequently stored and transferred between the treasury and bank outlets every day.

● At the bank vault side, the traditional manual operation method is still used for the transfer management of the cash box, which is not only labor-intensive and inefficient. At the same time, because the cash box enters and exits the treasury, only the quantity is simply registered, and the cash box such as the number and outlets is not registered in detail. Key elements such as name and time of entry and exit make it difficult to distinguish the true and false of the entry and exit cash box, and there are serious security loopholes.

● In the process of circulation, the transfer registration information between the main cashier and the clerk, and the clerk and the warehouse clerk cannot be shared. There is no linkage control mechanism for the three parties, and it is easy to take the cash drawer wrongly, miss it, and transfer the package.

● In terms of bank management, since the status of all cash drawers cannot be monitored in real time, it is extremely prone to blind spots in security management, and it is also impossible to command and dispatch the safe and scientific circulation of cash drawers on a unified management platform.

How to realize the intensive, automated, scientific, and refined bank cash drawer management, and ensure the fast and accurate deposit and withdrawal of the cash drawer on a unified management platform; correct registration and transfer to avoid errors such as mishandling, omission of taking, and swapping; Real-time monitoring of the cash drawer status to avoid security blind spots is of great significance to ensure the safety and scientific circulation of bank cash drawers, and it is also an urgent problem that banks need to solve in the course of rapid development.

Construction function

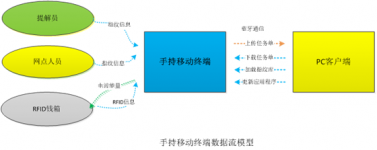

The remote identification RFID electronic tag is installed on the cash box, and the recording process of the cash box entering and exiting the vault and bank branch handover is automatically recorded through the identification electronic tag.

Trolleys are used to enter and exit the vault. Through the use of a door-type radio frequency reader, dozens of cash boxes in a cart can be quickly and easily accurately identified, and the system backend writes the data to the VCTS.

When the cash box is delivered to the business outlets for handover, a handheld radio frequency reader is used to record the in and out information of the bag. The information collection and operation of the cash box label is simple and the information is reported quickly and timely.

System Implementation

System advantages

1. Intensive, real-time, and automated bank cash box management has been realized. By connecting with the bank’s existing treasury management system platform, the bank’s refined management level has been effectively improved.

2. At the treasury side, through the application of this system, the cash drawer can be quickly and accurately moved in and out of the treasury, which completely changed the traditional manual operation method of the treasury, shortened the time of in and out of the treasury, greatly improved work efficiency and accuracy, and avoided This eliminates the security risks caused by the difficulty in distinguishing the authenticity of the inbound and outbound cash box.

3. At the business outlets, the electronic label information of the cash box is read to the bank’s treasury management system platform through the handheld scanner, which can effectively avoid the risk of mishandling or missing the cash drawer.

4. The bank’s ability to monitor the status of the cash box is improved. The bank can know the status of the cash box in the treasury, escort, and business outlets in real time through the system background. It avoids the blind spot of cash box supervision caused by untimely information feedback and the huge risks caused by it.

In short, the implementation and application of the system has great practical significance for the management of bank cashboxes in the transfer process, real-time status supervision, and avoiding risks caused by work errors. It has been consistent with the implementation of the system. The affirmation and praise.

[ad_2]